Lawmakers remove ‘revenge’ tax provision from Trump's big bill after Treasury Department request

Lawmakers remove ‘revenge’ tax provision from Trump's big bill after Treasury Department request

Congressional Republicans have agreed to remove the so-called revenge tax provision from President Donald Trump’s big bill

Read the full article on ABC US

Truth Analysis

Analysis Summary:

The article appears mostly accurate, with the core claim of lawmakers removing a "revenge tax provision" from Trump's bill after a Treasury Department request being supported by multiple sources. However, the use of the term "revenge tax provision" itself introduces a degree of bias. The article could benefit from a more neutral description of the provision.

Detailed Analysis:

- Claim:** Lawmakers remove ‘revenge’ tax provision from President Donald Trump’s big bill.

- Verification Source #1, #2, #3, #4: Support this claim. All sources have the same title, indicating agreement on the core fact.

- Claim:** The removal was after a Treasury Department request.

- Verification Source #1, #2, #4: Support this claim.

- Claim:** Treasury Secretary Scott Bessent asked members to remove the provision.

- Verification Source #1: States that Treasury Secretary Scott Bessent asked members to remove the provision.

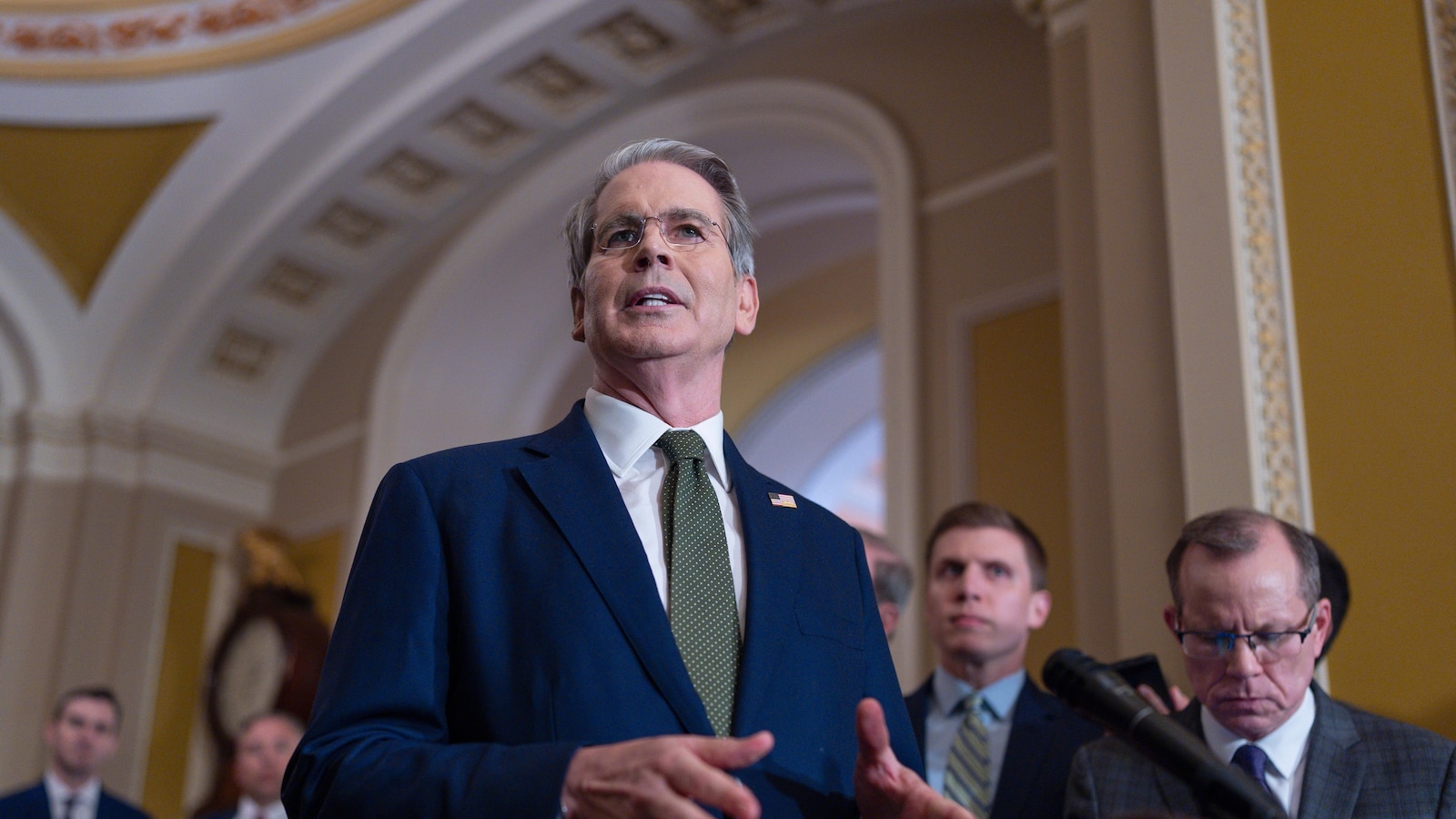

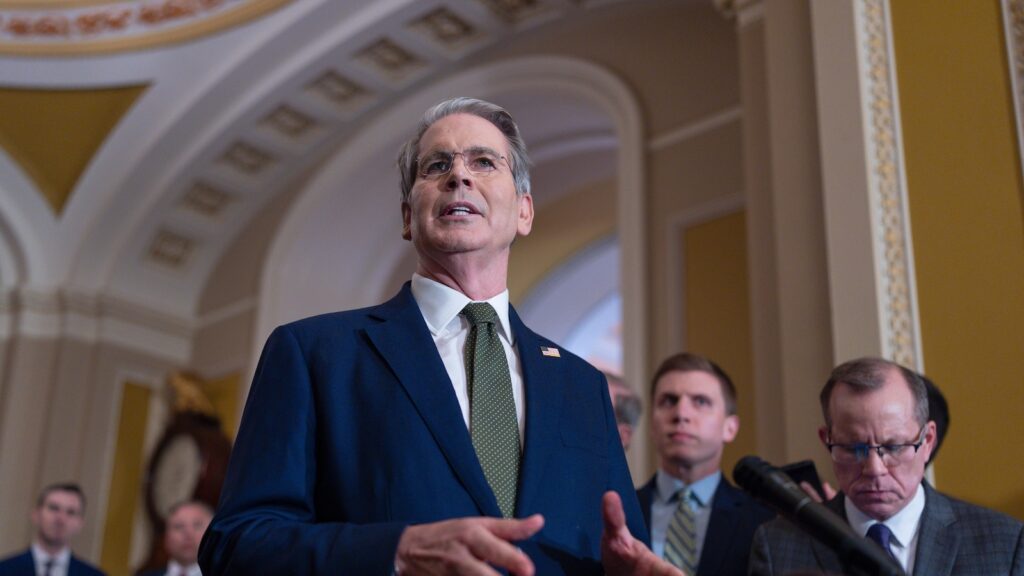

- Claim:** Senate Finance Committee Chairman Mike Crapo, R-Idaho, and House Ways and Means Committee Chairman Jason Smith.

- Verification Source #2: States that Senate Finance Committee Chairman Mike Crapo, R-Idaho, and House Ways and Means Committee Chairman Jason Smith were involved.

Supporting Evidence/Contradictions:

- The primary claim that lawmakers removed a "revenge tax provision" from Trump's bill after a Treasury Department request is consistently supported across Verification Source #1, #2, #3, and #4.

- Verification Source #1 specifically names Treasury Secretary Scott Bessent as making the request.

- Verification Source #2 names Senate Finance Committee Chairman Mike Crapo and House Ways and Means Committee Chairman Jason Smith as being involved.

- The term "revenge tax provision" is used consistently across all sources, which suggests it's a common descriptor, but it also carries a negative connotation, potentially indicating bias.